Lead a group of consultants and senior consultants in coding an automated timeseries forecasting package and utilizing Recursive Feature Elimination.

Helped an insurance company develop a macro-economic forecasting model to analyse the effects of climate change on the probability of default and actuarial credit spreads across various industries.

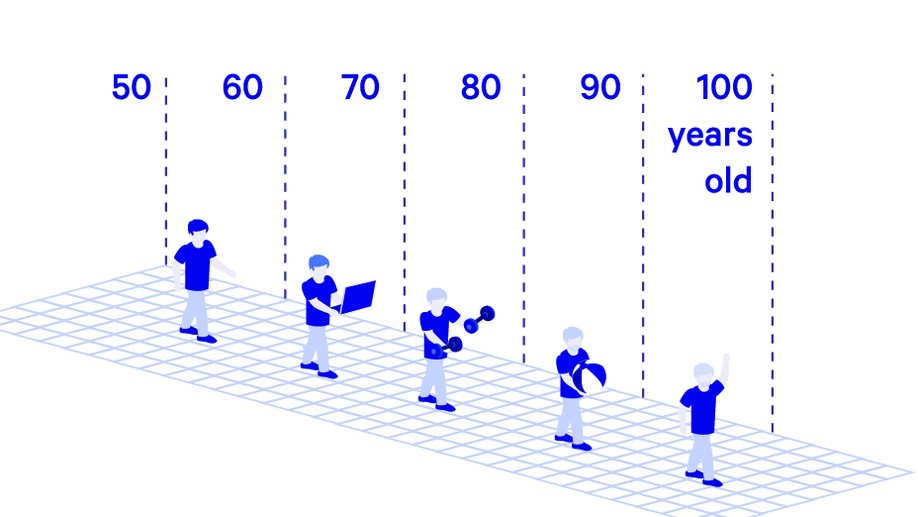

Developed multiple dynamic microsimulation model for various policy and scenario analysis.

Lead the development of an R shiny program to undergo geospatial data analysis with a focus on data visualization.

Utilized a variety of programming languages to help clients solve their data analytics problem within their cloud environment (Python, R, TeradataSQL, and PowerBI).

Trained graduates and consultants the coding skillsets needed to meet client deliverables

Managed and presented proposals to clients and helped ensure the engagement milestones were on track